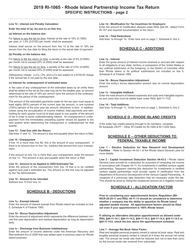

Unlike under TEFRA, if the examination results in an imputed underpayment of tax, a BBA partnership may pay the underpayment on behalf of the partners under Sec. 97- 248, the IRS conducts examinations at the partnership level to determine the accuracy of a partnership's tax return. Under the BBA, and much like under the Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA), P.L. The new procedures were enacted as a response to the fact that, among other things, the IRS had difficulty in conducting examinations of large, especially tiered, partnerships, where the collection of tax may be far removed from the partners of the partnership under exam. 31, 2017 (though partnerships could also elect to apply BBA procedures for certain prior tax years as well). The centralized partnership audit procedures went into effect for partnership tax years beginning after Dec. Whether the partnership should file an amended return, however, is a more complex question. This discussion first provides an overview of the AAR process and then explains why BBA partnerships do not need to rely on AARs to adjust their 2018 or 2019 tax returns under the relief granted in Rev.

The filing of an AAR can be a complex undertaking.

2020- 23, issued April 8, allows BBA partnerships to avoid having to file an administrative adjustment request (AAR), which, prior to this guidance, was the only way for a BBA partnership to make an adjustment to a previously filed tax return. Adjusting a partnership tax return under the BBA is not a simple task for the partnership or its partners. To the uninitiated, the filing of an amended return may not seem like a cause for celebration or note, but for BBA partnerships, it reflects a significant development. 114-74, now can file amended returns for tax years beginning in 20.

Partnerships subject to the centralized partnership audit rules of the Bipartisan Budget Act of 2015 (BBA), P.L.

0 kommentar(er)

0 kommentar(er)